Website Name

forsage.io

forsage1.io

ETHFastAndFuriouz.com

forsageSecrets.com

forsagebusdsystem.com

Website Type

Ethereum Smart Contract Matrix

Is Forsage Fake or Real?

Fake

Why Is Forsage Fake?

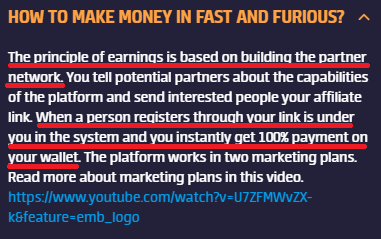

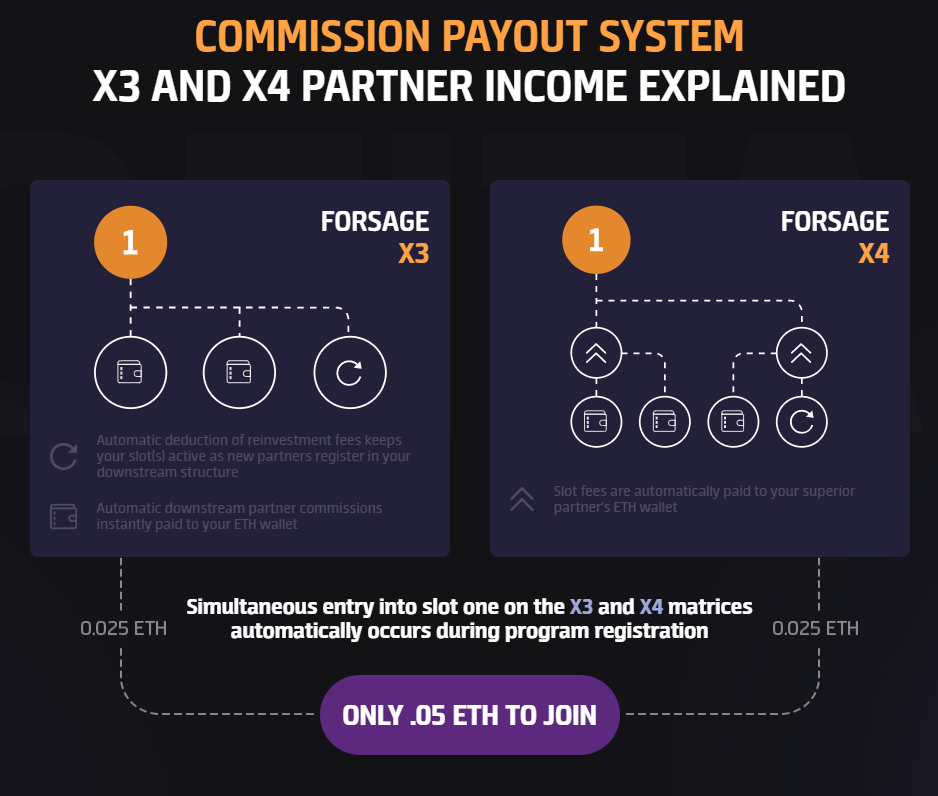

Forsage is an Ethereum smart contract matrix similar to AutoEtherBot which was covered previously. It is a scheme wherein you get commissions based on the number of investors you rope in to invest along with you. They offer 3×1 and 4×2 matrices, which simply means that you can have three people directly under you OR recruit two people who have two more people under them.

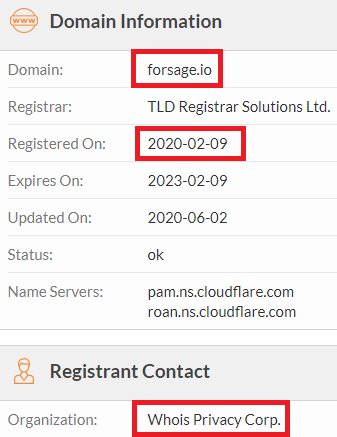

A domain name lookup of the website shows that it was registered on 9th February 2020. There is no information available about the registrant as it has been blocked for privacy.

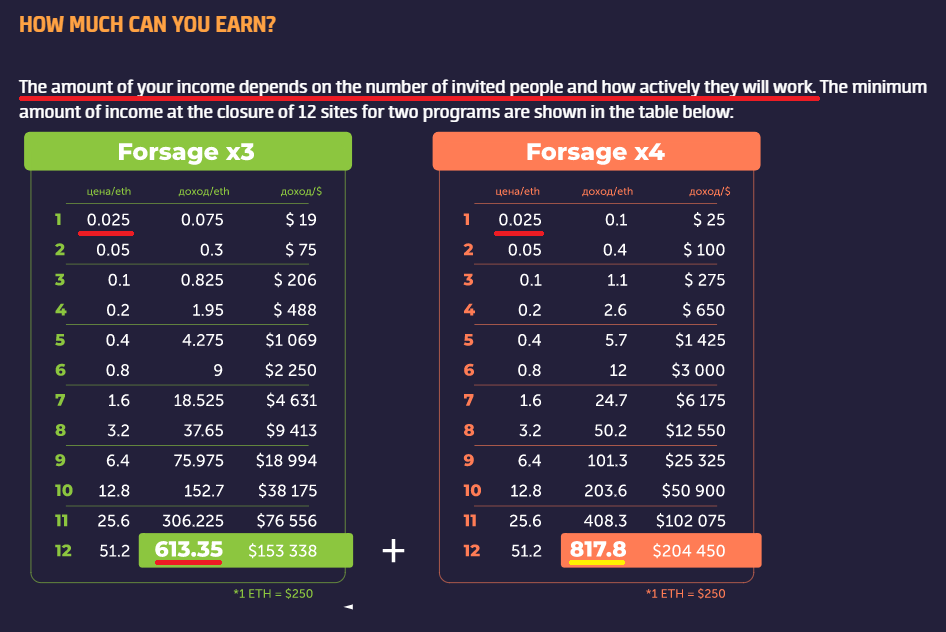

As per the table on the website which shows the minimum returns at the highest levels, the 3×1 matrix gives a return of 2,453,300% and the 4×2 matrix gives a return of 3,271,100%. The words ‘price’ and ‘income’ in the table are written in Russian which suggests a Russian origin for the scheme.

A Youtube video linked in the FAQs is also entirely in Russian. According to the website itself, the whole scheme simply involves recruiting investors and getting commissions based on how many people you recruit.

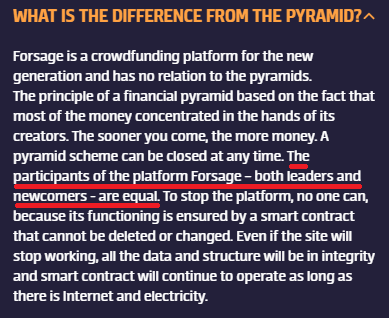

The creators of Forsage are aware of the fact that the structure is similar to a pyramid scheme and have made attempts to allay the fears. However, there is a tinge of dishonesty in their claims.

They claim that Forsage is not a pyramid scheme as all participants are equal in the blockchain. This is simply not true as the entire scheme is based on matrices aka pyramid. They also claim that there is no leader or admin. This may technically be true, but as the scheme is a pyramid structure, the person at the top always benefits more.

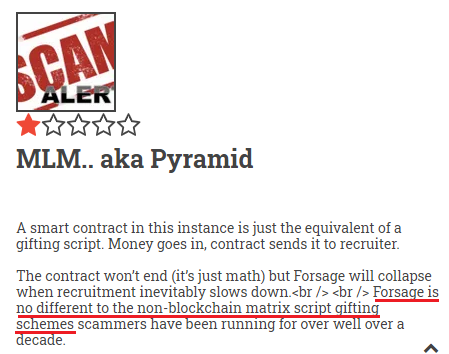

They also claim that the platform cannot collapse. Again, as this particular scheme involves making money through recruitment commissions, it is bound to collapse at a point when there are no more people who are willing to join the scheme.

There will definitely be an eventual slowdown in the recruitments and an inevitable standstill. This means that the returns will diminish over time and stop completely at a certain point, leaving the people at the bottom levels with no returns. Like all pyramid schemes, Forsage is giving investors the impression that there will be an endless number of people joining the scheme forever.

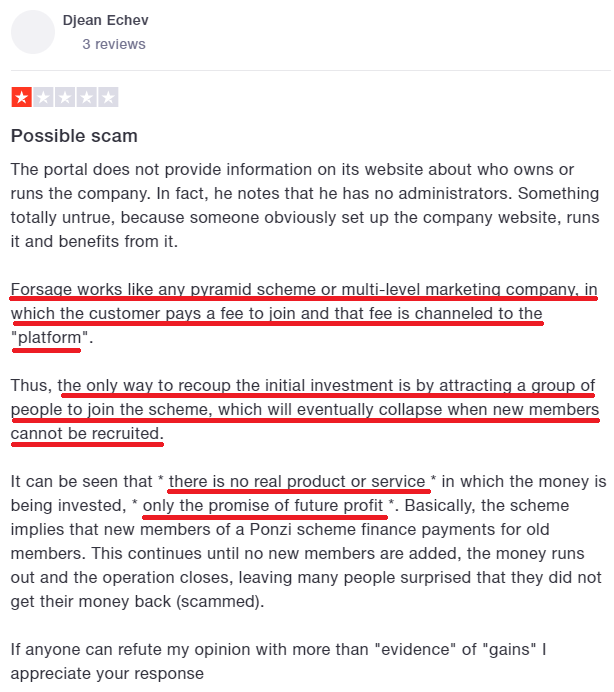

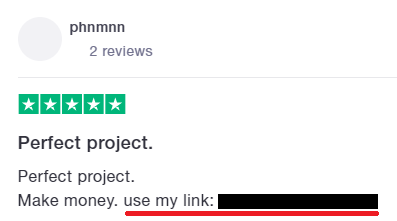

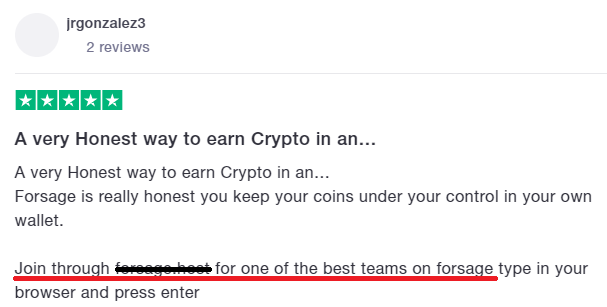

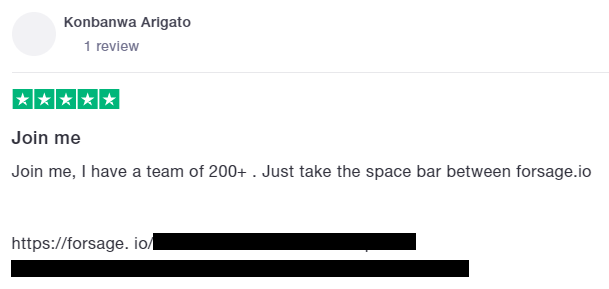

There are few reviews available online. Most of them are positive reviews from people who have invested in the scheme looking to recruit more people. The rest are by people warning that Forsage is a pyramid scheme.

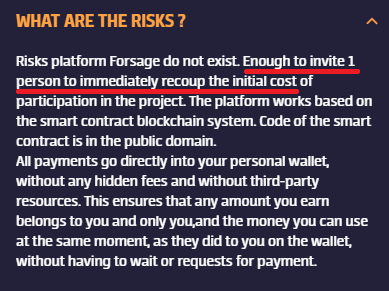

It’s obvious from the facts that Forsage is a pyramid scheme. There is no pretense of a product or service being involved. Money just moves from the lower levels to higher levels. Yet, the creators of Forsage are trying to claim that everyone is equal in the scheme. It’s simple logic that anyone who is unable to recruit two to three more people immediately loses their investment in Forsage.

The investors seem to be convinced that Forsage is not a pyramid scheme because it’s a decentralized smart contract. A smart contract is simply code that ensures automatic payments when conditions of the contract are met. The design of Forsage involves matrices and recruitment-based commissions which clearly makes it a pyramid scheme. Even though the blockchain is decentralized, the investment system is a Ponzi scheme. An ROI of 3,271,100% is only realistic in a pyramid scheme and such investment plans are illegal throughout the world.

Update 1

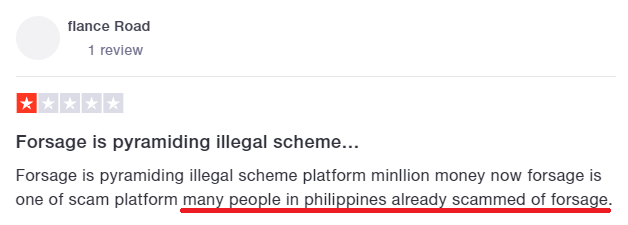

Forsage has officially been declared as a Pyramid Scheme by the Philippines Securities and Exchange Commission (SEC).

“Based on numerous reports and information gathered by the Commission, the entity operating under the name FORSAGE, headed by LADO OKHOTNIKOV, is found to be engaged in investment-taking activities in the Philippines which is NOT AUTHORIZED by the Commission,” the SEC noted.

The model of the DApp resembles with classic multi-level marketing (MLM) scheme as users profit by attracting more users to invest in multi-level “slots” – each slot is twice as expensive as the previous, and returns twice as much profit to the original referrer.

“Forsage’s so-called smart contract partakes of the nature of securities through an investment contract where investors need not exert any effort other than to invest or place money in its scheme in order to profit,” the regulator added.

“The public is advised NOT TO INVEST or STOP INVESTING in any scheme offered by FORSAGE or such other entities engaged in smart contracts, cryptocurrencies, and digital asset trading that are not registered with the Commission and the BSP,” the regulator warned.

Update 2

On Aug 1, 2022, The USA’s Securities and Exchange Commission charged eleven people related to Forsage.io for fraud. Below is an excerpt from the SEC’s official press release about Forsage.

The Securities and Exchange Commission today charged 11 individuals for their roles in creating and promoting Forsage, a fraudulent crypto pyramid and Ponzi scheme that raised more than $300 million from millions of retail investors worldwide, including in the United States. Those charged include the four founders of Forsage, who were last known to be living in Russia, the Republic of Georgia, and Indonesia, as well as three U.S.-based promoters engaged by the founders to endorse Forsage on its website and social media platforms, and several members of the so-called Crypto Crusaders—the largest promotional group for the scheme that operated in the United States from at least five different states.

According to the SEC’s complaint, in January 2020, Vladimir Okhotnikov, Jane Doe a/k/a Lola Ferrari, Mikhail Sergeev, and Sergey Maslakov launched Forsage.io, a website that allowed millions of retail investors to enter into transactions via smart contracts that operated on the Ethereum, Tron, and Binance blockchains. However, Forsage allegedly has operated as a pyramid scheme for more than two years, in which investors earned profits by recruiting others into the scheme. Forsage also allegedly used assets from new investors to pay earlier investors in a typical Ponzi structure.

Despite cease-and-desist actions against Forsage for operating as a fraud in September 2020 by the Securities and Exchange Commission of the Philippines and in March 2021 by the Montana Commissioner of Securities and Insurance, the defendants allegedly continued to promote the scheme while denying the claims in several YouTube videos and by other means.

Without admitting or denying the allegations, two of the defendants, Ellis and Theissen, agreed to settle the charges and to be permanently enjoined from future violations of the charged provisions and certain other activity. Additionally, Ellis agreed to pay disgorgement and civil penalties, and Theissen will be required to pay disgorgement and civil penalties as determined by the court. Both settlements are subject to court approval.

How to Get Your Money Back from a Scam

Remember: If something seems too good to be true, it probably is.

If you have been a victim of an investment scam, you can take the following steps:

- File a complaint with the payment portal. However, investment scammers mostly use methods such as Bitcoin, Western Union, MoneyGram and other untraceable methods which make refunds impossible.

- Leave a negative review on review portals such as Scamadviser and TrustPilot

- Report the website to Google using the Suspicious Site Reporter extension for Chrome

- Give a low rating to the website on Web of Trust. You can also install their extension for the same.

- If the company has a listing on Google My Business or Google Maps, file a complaint using the Business Redressal Complaint Form. Also, leave a negative review explaining what kind of experience you had.

Disclaimer: This review is intended for information only and should not be relied on when making financial or business decisions. If you are a website owner and would like to provide clarifications regarding your business and/or website, please get in touch using the Contact Form.